10 Best AI Crypto Trading Bots 2023

Are you ready to level up your cryptocurrency trading game? Imagine having an intelligent ally that can execute precise trades for you 24/7, adapting to market conditions without requiring you to spend endless hours studying complex strategies and parameters.

Welcome to the world of AI crypto trading bots – the game-changer for both novice and experienced traders.

Editor's Pick

Best AI Crypto Trading Bots 2023

1. 3Commas

3Commas is a crypto investment platform that empowers you to manage your assets across 16 major crypto exchanges through a single interface. Whether the market is bullish, bearish, or moving sideways, 3Commas offers automated trading bots that suit your needs.

Key Features

- Bot presets for beginners to follow expert strategies.

- Smart trading terminals for setting trades in advance.

- DCA, Grid, and Futures bots that execute strategies efficiently.

- Tools for buying the dips and selling the spikes.

- Integration with professional traders’ signals.

2. Altrady

Altrady enables you to trade on 17+ crypto exchanges and provides advanced features not available on these exchanges directly. With a range of bots and automation tools, Altrady can streamline your trading process and eliminate human errors.

Key Features

- GRID Bot with Trailing Up & Down.

- Signal Bot for Spot & Futures trading.

- Risk-based size calculation for position sizing.

- Automation tools for efficient trading.

3. Pionex

Pionex is a comprehensive trading platform that provides access to multiple types of bots, including Grid Trading, DCA (Dollar Cost Averaging), and Rebalancing bots. What sets Pionex apart is its commitment to user-friendly trading and low fees.

Key Features

- 16 free trading bots and up to 100x leverage.

- Low trading fees at 0.05% for both makers and takers.

- Integration with TradingView strategies.

- No need for APIs to connect to external exchanges.

4. Kryll

Kryll offers automation software and AI-powered trading bots that simplify crypto trading for both beginners and experts. With a drag-and-drop interface, users can create custom bots, and the Marketplace allows you to access strategies created by experienced traders.

Key Features

- Crypto Builder for creating custom scripts.

- Marketplace for sharing and accessing trading strategies.

- Trading Terminal for setting stop-loss and take-profit levels.

- Strategy Editor with a user-friendly interface.

5. ArbitrageScanner

ArbitrageScanner.io offers traders the opportunity to capitalize on price differences across exchanges without the need to hold tokens in advance. This strategy involves buying a coin on one exchange at a lower price and selling it on another at a higher rate.

Key Features

- Supports over 75 DEX and CEX exchanges.

- Manual bot operation for enhanced security.

- Free training and access to a supportive community.

- Personal mentor for Expert plan users.

6. Zenbot

Zenbot is an open-source, command-line cryptocurrency trading bot that’s ideal for tech-savvy traders looking for customization. As an open-source project, Zenbot is continuously evolving with contributions from a global community of developers.

Key Features

- Open-source, allowing for customization and community support.

- Access to multiple trading strategies.

- Extensive backtesting and simulation capabilities.

- Compatible with various cryptocurrency exchanges.

7. Zignaly

Zignaly combines social trading with automation, allowing users to follow the trading strategies of experienced traders and execute them automatically. This is perfect for traders who want to leverage the wisdom of experts.

Key Features

- Integration with top crypto exchanges.

- Copy trading from experienced traders.

- Automated order execution following chosen strategies.

- Trade management features for risk control.

8. Bitsgap

Bitsgap allows you to connect all your exchanges in one place, streamlining your trading experience. It offers access to over 10,000 cryptocurrency trading pairs and various technical indicators to fine-tune your strategies.

Key Features

- Integration with 30 different exchanges.

- Proportionate distribution of investments within your chosen range.

- Simplified rate comparison and strategy testing.

- User-friendly interface suitable for beginners and professionals.

9. CryptoHopper

CryptoHopper is a multi-purpose platform that combines social trading, investment portfolio management, and more. It offers free trading bot creation and testing, along with features like backtesting and an intuitive user interface.

Key Features

- Trade in multiple cryptocurrencies and exchanges.

- Semi-automated trading to remove emotions.

- A wide range of trading tools and indicators.

- Excellent customer support for assistance.

10. CryptoHero

CryptoHero, created by experienced fund managers, offers access to hundreds of cryptocurrencies and integration with top crypto exchanges. The platform uses AI to optimize trading parameters and offers backtesting for strategy improvement.

Key Features

- Backtesting to refine trading strategies.

- Entry and exit condition customization.

- User-friendly interface for efficient trading.

- Access to a wide range of cryptocurrencies.

FAQs About AI Crypto Trading Bots

What are AI crypto trading bots?

AI crypto trading bots are computer programs that use artificial intelligence and machine learning algorithms to automate cryptocurrency trading. They analyze market data, execute trades, and manage portfolios without human intervention.

How do AI crypto trading bots work?

These bots work by continuously monitoring cryptocurrency markets, analyzing historical data, and making trading decisions based on predefined strategies or machine learning models. They can execute buy and sell orders, manage risk, and adapt to changing market conditions.

Are AI trading bots suitable for beginners?

Yes, many AI trading bots are designed with user-friendliness in mind. They offer preset strategies and user interfaces that make it accessible for beginners. Some even provide copy trading options, allowing novices to follow the strategies of experienced traders.

What types of strategies do these bots use?

AI crypto trading bots can employ a wide range of strategies, including market-making, arbitrage, trend following, scalping, and more. The choice of strategy depends on the bot’s capabilities and the user’s preferences.

Do I need to have coding skills to use these bots?

No, most AI crypto trading bots are designed for users without coding expertise. They typically offer user-friendly interfaces and preset strategies, making them accessible to traders of all skill levels.

Are AI crypto trading bots safe?

The safety of AI trading bots largely depends on the platform and the measures taken to secure user accounts and funds. It’s essential to choose a reputable and secure platform, enable two-factor authentication, and use strong, unique passwords to enhance security.

What are the costs associated with using AI trading bots?

Costs can vary significantly between platforms. Some bots offer free basic versions with limited features, while others require a subscription fee or charge a percentage of your trading profits. It’s crucial to understand the pricing structure before choosing a bot.

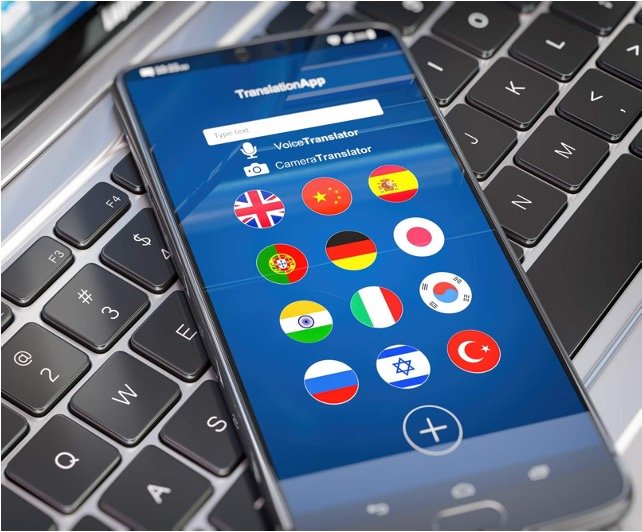

Which exchanges are compatible with these bots?

The compatibility of AI crypto trading bots depends on the platform. Most bots support popular exchanges like Binance, Coinbase, Kraken, and more. It’s essential to check if the bot you’re interested in is compatible with the exchanges you use.

Can I use multiple bots simultaneously?

Yes, you can use multiple bots simultaneously, but it’s important to manage and monitor them carefully. Using multiple bots allows you to diversify your trading strategies and reduce risk.

Do I still need to research the crypto market when using bots?

While bots can automate trading, it’s still essential to have a basic understanding of the crypto market and stay informed about market developments. Bots are tools to assist your trading decisions, not replacements for your knowledge.

Are there risks associated with using AI trading bots?

Yes, like any form of trading, using AI crypto trading bots involves risks. These include technical issues, unexpected market volatility, and losses due to incorrect strategies. It’s crucial to use risk management tools and start with a strategy you understand.

Can I customize the trading strategies of these bots?

Many AI crypto trading bots offer customization options. Users can adjust parameters, set their own trading rules, or create entirely custom strategies. The level of customization varies by platform.

How do I choose the right AI crypto trading bot for me?

To choose the right bot, consider factors such as your trading goals, experience level, the features you need, security measures, and costs. It’s also a good idea to read user reviews and seek recommendations from other traders.