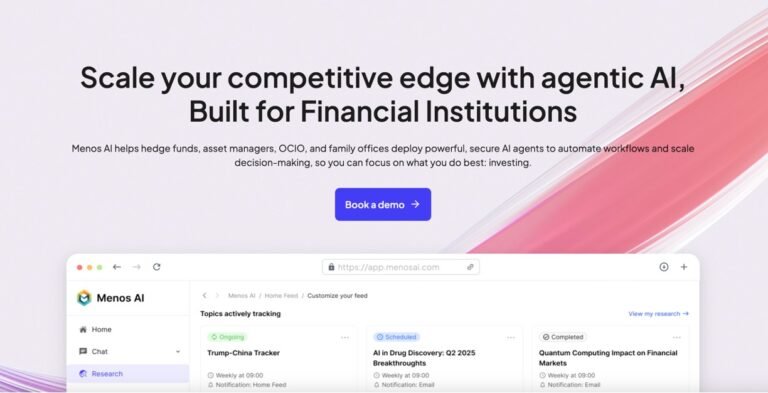

Menos AI is a cutting-edge platform designed for institutional investors, hedge funds, and asset managers looking to enhance portfolio management, research, and compliance using artificial intelligence. The platform deploys a suite of AI agents specializing in portfolio analytics, alpha research, and regulatory compliance, enabling clients to make better investment decisions, identify trading opportunities, and streamline reporting. By consolidating multi-asset financial data and offering an intuitive, conversational user experience, Menos AI empowers investment teams to focus on strategic thinking rather than manual data processing.

Key Features

-

AI-powered Research Agents: Cut through information overload and surface actionable investment ideas using proprietary algorithms.

-

Portfolio Analytics & Risk Management: Receive clear, data-driven insights and dynamic risk evaluation for smarter asset allocation.

-

Automated Compliance Monitoring: 24×7 monitoring and automatic generation of regulatory reports to help maintain industry compliance.

-

Unified Data Foundation: Integrates and enriches financial data into a single, secure platform for reliable portfolio management.

Use Cases

-

Institutional investors aiming to identify alpha-generating (profit-making) opportunities faster and more reliably.

-

Hedge funds seeking real-time risk management and portfolio optimization using AI-enhanced analytics.

-

Asset managers needing to automate compliance reporting and continuous monitoring of investment guidelines.